The Of Clark Wealth Partners

The 5-Minute Rule for Clark Wealth Partners

Table of ContentsClark Wealth Partners Fundamentals ExplainedClark Wealth Partners Can Be Fun For EveryoneSome Known Details About Clark Wealth Partners Not known Details About Clark Wealth Partners Top Guidelines Of Clark Wealth PartnersThe Single Strategy To Use For Clark Wealth PartnersEverything about Clark Wealth PartnersLittle Known Facts About Clark Wealth Partners.

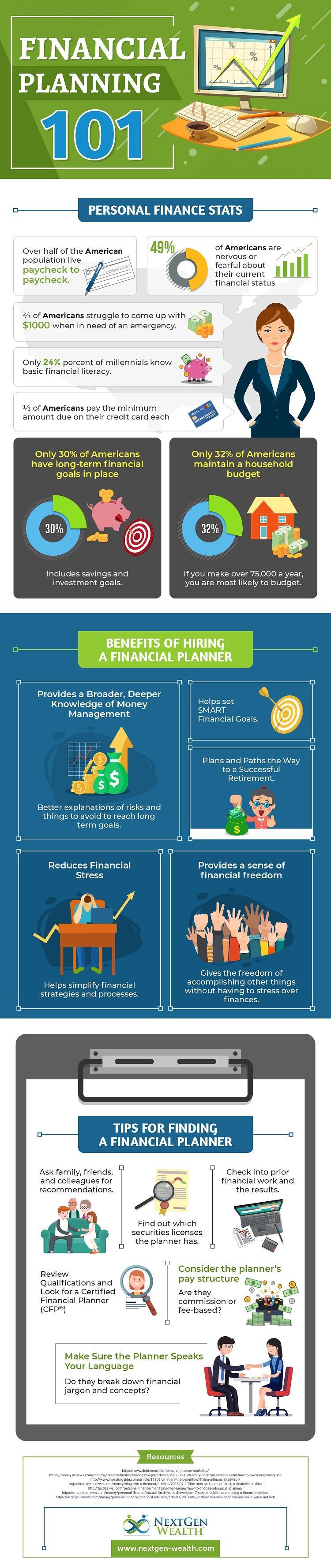

Typical reasons to take into consideration an economic consultant are: If your economic circumstance has come to be more intricate, or you lack self-confidence in your money-managing abilities. Saving or browsing significant life events like marital relationship, divorce, kids, inheritance, or task adjustment that may considerably affect your monetary situation. Navigating the shift from saving for retirement to protecting riches throughout retired life and exactly how to create a strong retired life revenue plan.New modern technology has actually caused more comprehensive automated financial tools, like robo-advisors. It depends on you to explore and identify the best fit - https://penzu.com/p/10bc905112757bff. Ultimately, an excellent financial consultant must be as conscious of your investments as they are with their very own, avoiding excessive charges, conserving money on tax obligations, and being as clear as feasible concerning your gains and losses

The 45-Second Trick For Clark Wealth Partners

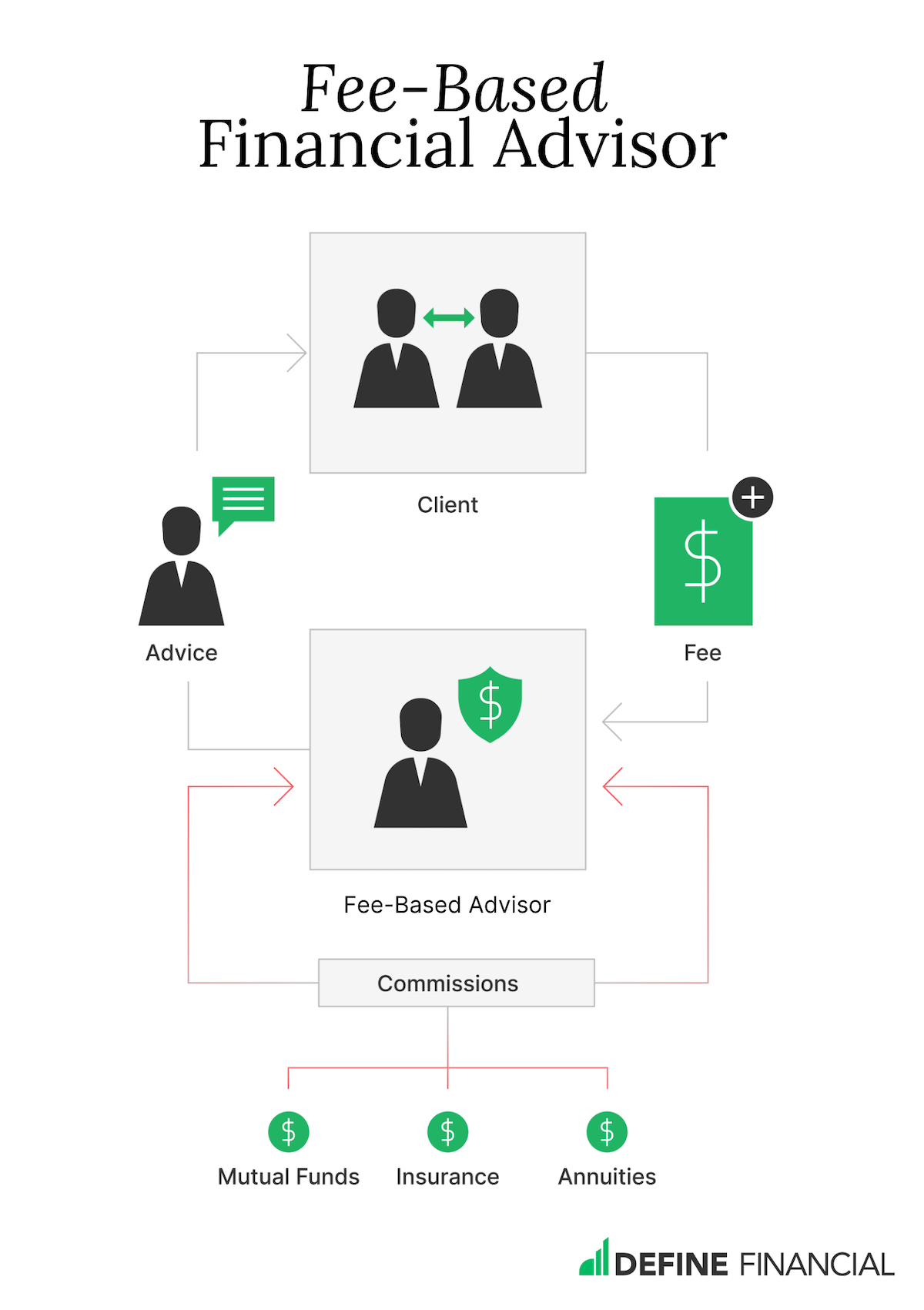

Earning a compensation on product suggestions doesn't always imply your fee-based advisor antagonizes your ideal interests. But they may be extra inclined to suggest items and services on which they gain a commission, which might or might not remain in your ideal rate of interest. A fiduciary is legally bound to place their customer's passions.

This typical allows them to make recommendations for investments and solutions as long as they suit their client's goals, threat tolerance, and financial scenario. On the various other hand, fiduciary consultants are legitimately bound to act in their customer's best rate of interest instead than their very own.

Clark Wealth Partners Fundamentals Explained

ExperienceTessa reported on all things investing deep-diving into complex economic subjects, clarifying lesser-known financial investment opportunities, and revealing means readers can function the system to their advantage. As an individual money specialist in her 20s, Tessa is acutely knowledgeable about the impacts time and unpredictability have on your financial investment decisions.

It weblink was a targeted advertisement, and it functioned. Learn more Check out much less.

Our Clark Wealth Partners Ideas

There's no single course to ending up being one, with some individuals starting in financial or insurance coverage, while others begin in bookkeeping. 1Most monetary coordinators start with a bachelor's level in money, business economics, audit, organization, or a related subject. A four-year level gives a strong structure for careers in investments, budgeting, and customer service.

Our Clark Wealth Partners Diaries

Usual instances include the FINRA Collection 7 and Collection 65 exams for securities, or a state-issued insurance policy permit for marketing life or health insurance. While credentials might not be lawfully needed for all preparing roles, employers and customers usually watch them as a standard of expertise. We take a look at optional qualifications in the next area.

The majority of economic planners have 1-3 years of experience and experience with monetary products, conformity requirements, and direct customer interaction. A strong educational history is essential, however experience demonstrates the ability to use concept in real-world settings. Some programs integrate both, enabling you to complete coursework while earning supervised hours with teaching fellowships and practicums.

Clark Wealth Partners Things To Know Before You Get This

Early years can bring long hours, pressure to construct a customer base, and the need to consistently show your know-how. Financial coordinators enjoy the possibility to function very closely with clients, guide important life decisions, and typically attain adaptability in timetables or self-employment.

Riches supervisors can boost their earnings via commissions, possession costs, and efficiency perks. Monetary managers supervise a team of financial planners and advisors, setting department method, taking care of compliance, budgeting, and guiding interior procedures. They spent much less time on the client-facing side of the sector. Almost all financial managers hold a bachelor's degree, and numerous have an MBA or comparable graduate level.

The Ultimate Guide To Clark Wealth Partners

Optional certifications, such as the CFP, commonly call for additional coursework and testing, which can extend the timeline by a pair of years. According to the Bureau of Labor Statistics, individual monetary consultants earn a mean annual annual wage of $102,140, with leading income earners earning over $239,000.

In other districts, there are guidelines that need them to meet specific needs to make use of the monetary consultant or economic organizer titles. For financial organizers, there are 3 typical designations: Qualified, Personal and Registered Financial Organizer.

The Ultimate Guide To Clark Wealth Partners

Where to discover an economic consultant will depend on the type of suggestions you require. These establishments have team that may aid you recognize and buy particular kinds of financial investments.